Insurance Services Highlights

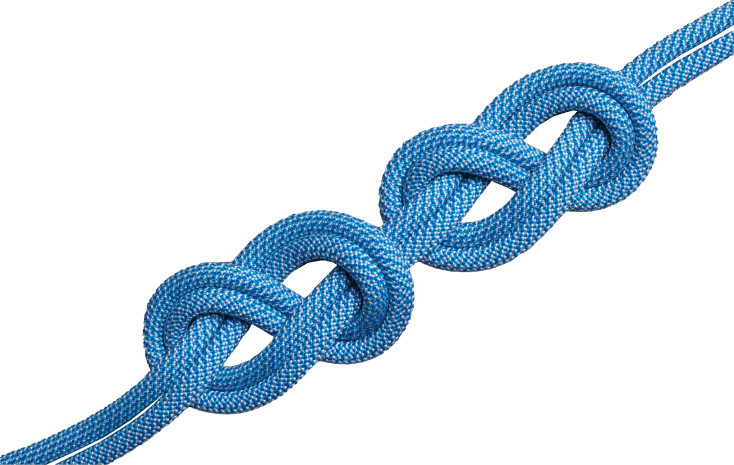

Our investment approach is a consultative one and includes the following tenets:

Needs Analysis: Assessing the client’s financial situation, goals, and family obligations to determine the appropriate amount and type of life insurance needed.

Policy Selection: Advising on various types of life insurance policies, such as term life, whole life, universal life, and variable life insurance, based on the client’s needs and financial goals.

Product Comparison: Comparing different insurance products and providers to find the best policy in terms of coverage, cost, and benefits.

Underwriting Assistance: Helping clients understand the underwriting process, which includes health assessments and other factors that may affect premiums and coverage.

Ongoing Reviews: Regularly reviewing and updating life insurance policies to ensure they continue to meet the client’s needs as their life circumstances change (e.g., marriage, having children, changing income levels).

Beneficiary Designation: Advising on how to designate and update beneficiaries to ensure that the death benefit is distributed according to the client’s wishes.

CANE Experts

Highlighting a CANE team member that excels at Insurance Services:

Lawrence A. Whalen II

Director of Insurance Operations

Ben Comer, CFP®

Insurance Product LeaderLet’s talk about Insurance Services

We’re looking forward to talking

Need help with your insurance services? CANE can help.

Connect with CANE

Get in touch. Anytime.

Protect your financial interests by having your planning needs met.