Retirement Plan Services Highlights

Financial advisers offer a range of specialized services to 401(k) plan sponsors to help them manage and optimize their retirement plans. These services ensure the plan is compliant, effective, and aligned with the needs of both the organization and its employees. Here’s a comprehensive overview of the key 401(k) services provided to plan sponsors:

Plan Design and Implementation: Assisting in designing a 401(k) plan that meets the specific needs of the organization and its employees. This includes selecting plan features, contribution structures, and matching formulas.

Compliance and Regulatory Guidance: Ensuring the plan complies with relevant laws and regulations, such as the Employee Retirement Income Security Act (ERISA) and the Internal Revenue Code (IRC). This includes preparing for and managing compliance audits, filing required forms, and staying updated on regulatory changes.

Investment Selection and Monitoring: Advising on the selection and ongoing monitoring of investment options offered in the plan. This involves conducting due diligence on investment managers, evaluating fund performance, and ensuring the investment lineup aligns with fiduciary responsibilities.

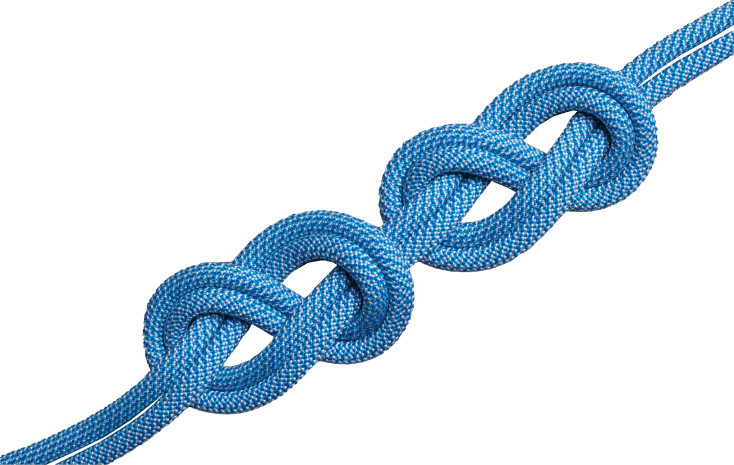

Fiduciary Responsibility and Support: Providing guidance on fiduciary responsibilities to help plan sponsors meet their obligations and mitigate risk. This includes offering tools and resources for fiduciary training and ensuring adherence to fiduciary best practices.

Plan Participant Education & Advice: Developing and delivering educational programs for plan participants to help them understand the plan, investment options, and retirement planning. This includes workshops, webinars, and one-on-one counseling sessions.

Plan Review and Benchmarking: Conducting regular reviews and benchmarking of the 401(k) plan against industry standards and peer organizations. This helps identify areas for improvement and ensures the plan remains competitive and effective.

Participant Enrollment and Communication: Supporting the enrollment process for new participants and managing ongoing communication regarding plan changes, updates, and important deadlines.

Retirement Readiness Planning: Helping plan participants assess their retirement readiness and create personalized retirement savings strategies. This includes forecasting retirement income needs and evaluating current savings progress.

Risk Management: Identifying and mitigating risks associated with plan management, including litigation risk and operational risks.

CANE Experts

Highlighting a CANE team member that excels at 401K Planning:

Christopher R. Connolly CRPS®, AIF®

PartnerLet’s talk about 401k planning

We’re looking forward to talking

Need help with your 401k planning? CANE can help.

Connect with CANE

Get in touch. Anytime.

Protect your financial interests by having your planning needs met.